The cryptocurrency market has witnessed the rise of several meme coins, collectively known as the Boys Club. This group includes PEPE, BRETT, ANDY, and LANDWOLF, each carving out its niche by leveraging humour, viral marketing, and strong community support. Here’s a closer look at these coins and their impact on the crypto landscape. The Boys Club Meme Coins: Taking Over the Crypto World.

What Are Meme Coins?

Meme coins are cryptocurrencies inspired by internet memes, cultural references, or jokes. Unlike traditional cryptocurrencies, which are developed with specific technological innovations or financial solutions in mind, meme coins primarily leverage viral marketing and community engagement to gain traction.

Check out: UAE CRYPTO: THE FUTURE OF FINANCE

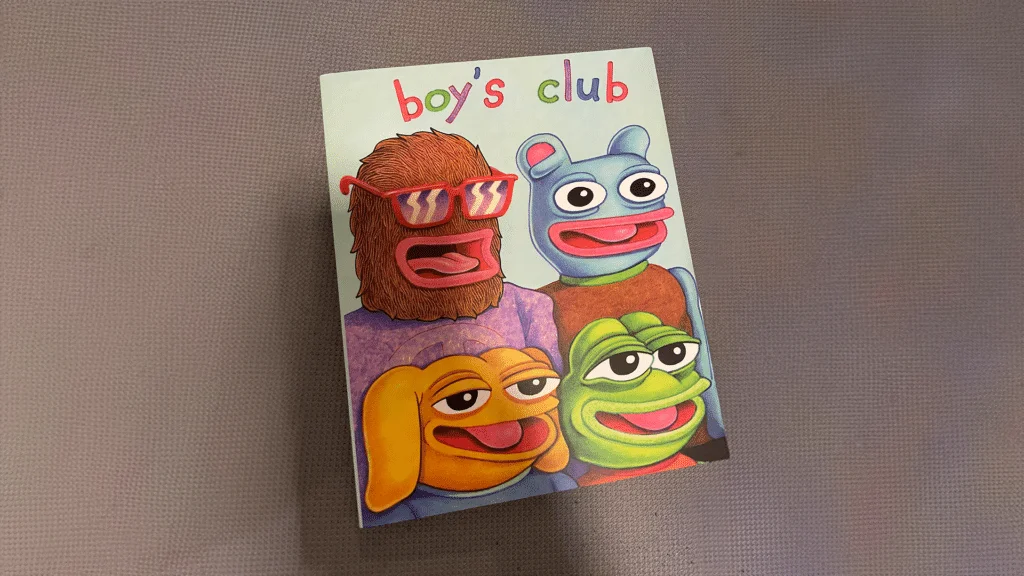

History of the Boys Club Art by Matt Furie

Matt Furie, an American artist and illustrator, created the Boys Club art series, which debuted in 2005. The series features a group of anthropomorphic characters navigating humorous and surreal everyday scenarios. Among these characters is Pepe the Frog, who later became an internet meme, catapulting Furie’s work into mainstream awareness. Furie’s Boys Club art is characterized by its playful yet satirical take on contemporary life, blending absurdity with a keen commentary on youth culture. The series has been influential in both the comic and internet meme landscapes.

Boys Club: Origins and Characteristics

The Boys Club refers to the group of meme coins created by male-dominated communities that use internet culture and humour to attract attention and build a strong following. Key characteristics include:

- Humor and Satire:

- These coins are based on humorous concepts or internet memes, creating a fun and engaging experience for users.

- Community-Driven:

- The success of these coins relies heavily on active participation in social media platforms like Reddit, Twitter, and Discord.

- Viral Marketing:

- Utilizing catchy names, funny memes, and engaging content, these coins spread quickly and attract a wide audience.

Prominent Boys Club Meme Coins

1. PEPE:

- Origin: Inspired by the popular “Pepe the Frog” meme, PEPE leverages nostalgia and internet culture.

- Community: Known for its active and humorous community, PEPE engages users through social media and community events.

- Impact: PEPE’s success showcases the power of memes in driving crypto adoption.

2. BRETT:

- Origin: Created as a satirical take on the crypto market, BRETT aims to entertain while providing a viable investment.

- Community: The BRETT community is vibrant and creative, contributing to its viral spread.

- Impact: BRETT highlights the role of humor and community in the crypto world.

3. ANDY:

- Origin: ANDY was launched to capitalize on the popularity of the Andy Warhol-inspired digital art trend.

- Community: Strong community engagement and creative marketing have propelled ANDY’s growth.

- Impact: ANDY demonstrates the potential of art and culture in meme coin success.

4. LANDWOLF:

- Origin: LANDWOLF combines the mystique of wolves with meme culture, creating a unique and appealing concept.

- Community: Enthusiastic supporters and innovative promotions have made LANDWOLF a notable player.

- Impact: LANDWOLF’s rise underscores the importance of originality and community support.

Factors Driving Popularity

**1. Nostalgia and Relatability:

- By tapping into cultural references and humor, these coins create a sense of familiarity and fun.

**2. Speculative Investment:

- The potential for high returns attracts speculative investors, especially with the low initial price of these coins.

**3. Community and Engagement:

- Strong social media presence and active community participation drive loyalty and spread awareness.

**4. Celebrity Endorsements:

- Mentions from celebrities and influencers can significantly boost a coin’s visibility and value.

**5. Accessibility and Simplicity:

- Meme coins are often easier to understand and more accessible than traditional cryptocurrencies.

Potential Risks and Challenges

**1. Volatility:

- Meme coins are highly volatile, with prices driven by social media trends and market sentiment.

**2. Lack of Utility:

- Many meme coins lack clear use cases, relying primarily on speculation and community sentiment.

**3. Regulatory Scrutiny:

- Increased regulatory attention could impact the trading and value of these tokens.

**4. Scams and Fraud:

- The meme coin space is susceptible to scams, making thorough research crucial before investing.

The Future of Boys Club Meme Coins

The future of Boys Club meme coins is uncertain yet promising. Their success will depend on their ability to maintain strong communities, provide value, and navigate market and regulatory challenges. As the cryptocurrency market evolves, these coins will likely continue to drive innovation and community engagement.

Conclusion

Boys Club meme coins, including PEPE, BRETT, ANDY, and LANDWOLF, have captured the crypto world’s attention through humour, community, and viral marketing. While offering exciting opportunities, they also come with significant risks. Potential investors should approach these coins with caution, conducting thorough research and being prepared for volatility.

{ “@context”: “https://schema.org”, “@type”: “Person”, “name”: “Robert Dobalina”, “url”: “https://whatshotinuae.com/author/robert-dobalina/”, “sameAs”: [ “https://medium.com/@robert_81109”, “https://mastodon.social/@RobertDobalina”, “https://muckrack.com/robert-dobalina”, “https://vocal.media/authors/robert-dobalina” ] }