Cryptocurrency can seem confusing, especially if you’re not familiar with tech or finance. The Normie’s guide to crypto explains the basics, including the recent trend of meme coins like Brett, Pei Pei, and Draggy.

What is Cryptocurrency?

Cryptocurrency is a type of digital money. Unlike regular money (like dollars or euros), which is issued by governments, cryptocurrencies are created and managed using computer technology called blockchain. For anyone diving into this realm, The Normie’s guide might offer valuable insights.

Understanding Blockchain

Think of blockchain as a digital ledger or record book that is open for everyone to see. Here’s how it works in simple terms:

- Starting a Transaction: Imagine you want to send some digital money to a friend. You create a transaction.

- Verification: This transaction is sent to a network of computers (called nodes) that check if everything is okay and approve it.

- Creating a Block: Approved transactions are grouped together to form a block.

- Adding to the Blockchain: This block is then added to a chain of previous blocks (hence, blockchain). This chain is permanent and cannot be changed.

- Completing the Transaction: Your transaction is now complete, and everyone can see it in the blockchain. This transparent process forms an essential part of what The Normie’s guide to crypto covers.

Key Terms in Cryptocurrency

- Bitcoin (BTC): The first and most famous cryptocurrency.

- Altcoins: Any cryptocurrency other than Bitcoin, like Ethereum or Litecoin.

- Wallet: A digital tool to store, send, and receive cryptocurrency.

- Private Key: A secret code that lets you access your cryptocurrency.

- Public Key: An address that others can use to send cryptocurrency to you. These are fundamental terms explained in The Normie’s guide.

How to Buy Cryptocurrency

- Choose a Platform: Pick a website or app where you can buy and sell cryptocurrency, such as Coinbase or Binance.

- Create an Account: Sign up and verify your identity.

- Deposit Money: Add some money to your account using a bank transfer or credit card.

- Buy Cryptocurrency: Use your money to buy the cryptocurrency you want. Follow The Normie’s guide to navigate this process.

- Secure Your Investment: Move your cryptocurrency to a secure wallet.

The Rise of Meme Coins

Recently, “meme coins” have become very popular. These are cryptocurrencies that start as jokes or memes but can quickly gain value if people start buying them.

Notable Meme Coins

- Dogecoin (DOGE): Started as a joke based on a popular dog meme. It has become very popular and is used for online tipping and charity.

- Shiba Inu (SHIB): Another dog-themed coin, created as a fun experiment and has seen significant price changes due to social media hype. Both these coins are mentioned in The Normie’s guide.

Latest Meme Coins: Brett, Pei Pei, and Draggy

- Brett: Named after an internet personality, it’s a playful coin that has attracted many fans.

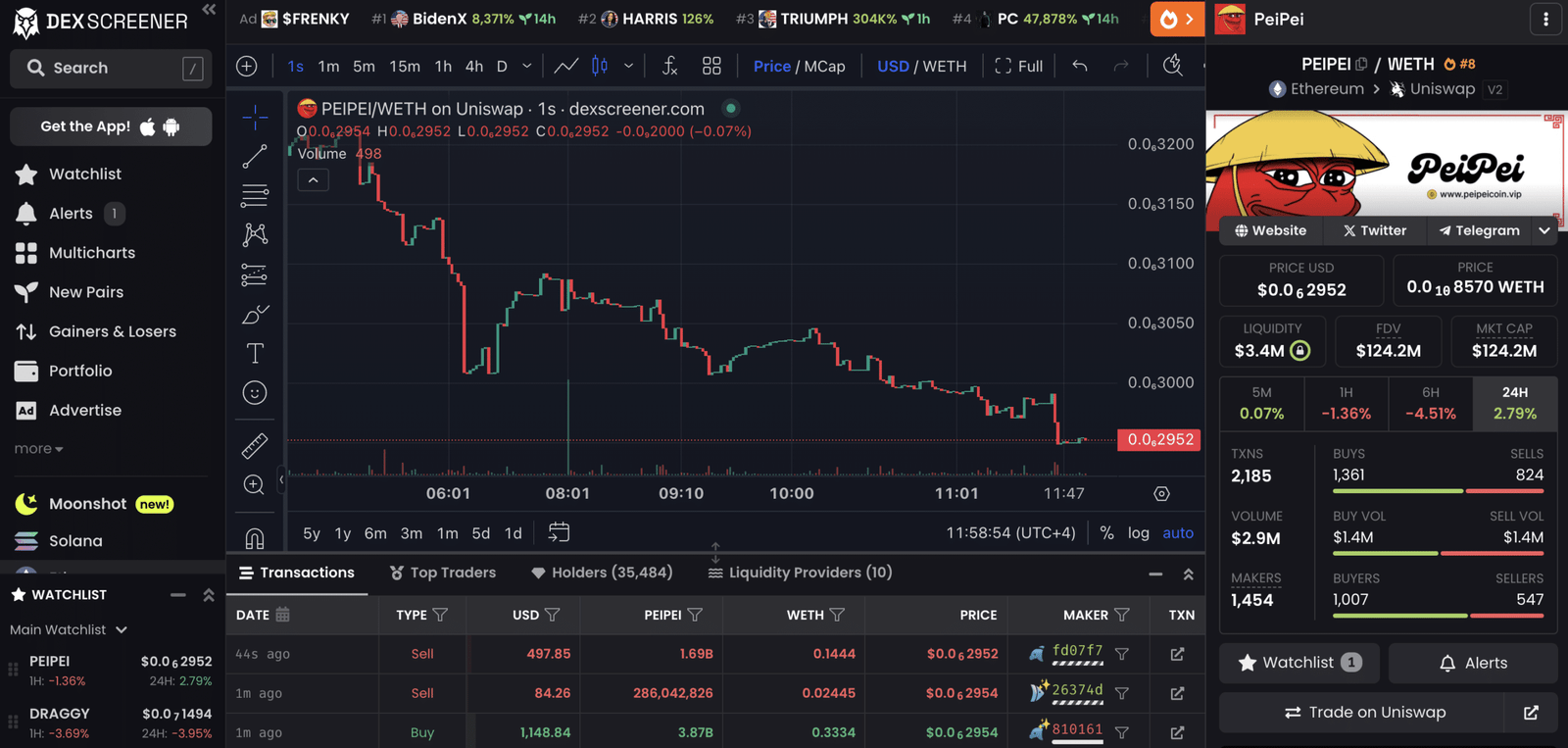

- Pei Pei: Features a fun mascot and is popular with young investors looking for big gains.

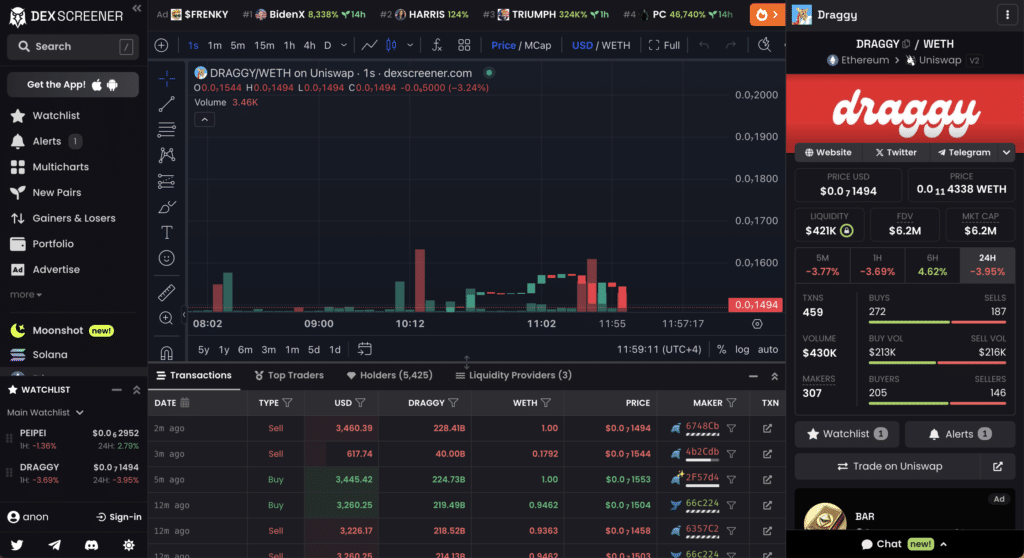

- Draggy: Inspired by dragon memes and fantasy culture, it’s gained a lot of attention recently.

Risks and Considerations

Meme coins can make you money quickly, but they are very risky. Their prices can go up and down a lot because they rely on hype and trends. Be careful and research before investing. The Normie’s guide offers insights into these risks.

The Future of Cryptocurrency

Cryptocurrency is still new and constantly changing. New developments like decentralized finance (DeFi) and digital collectibles (NFTs) are expanding what cryptocurrencies can do. As more people use cryptocurrencies, and as governments create rules for them, they will likely become a bigger part of our financial system.

Conclusion

Cryptocurrency is a new type of digital money that can seem complicated, but understanding the basics will help you get started. Meme coins like Brett, Pei Pei, and Draggy show how playful and unpredictable this market can be. Always stay informed and be cautious when investing.

For more simple and detailed updates on cryptocurrency and financial trends, visit What’s Hot in UAE.