This week, the emergence of DeepSeek, a Chinese-developed AI chatbot, sent shockwaves across the technology industry. It also impacted financial markets and the AI landscape. In a matter of days, this revolutionary app disrupted Silicon Valley’s dominance in artificial intelligence. Furthermore, it triggered a historic sell-off of tech stocks and reshaped global perceptions of AI development. Venture capitalist Marc Andreessen aptly described the moment as “AI’s Sputnik moment,” drawing parallels to the Cold War-era space race. Either way, DeepSeek’s disruption has had financial implications.

DeepSeek’s sudden rise has placed a spotlight on China’s growing influence in the tech sector. It has exposed vulnerabilities in the United States’ position as a global leader in AI. The speed and scale of its impact have been nothing short of transformative. Moreover, it is raising critical questions about costs, innovation, and geopolitics in the AI arms race.

The Rise of DeepSeek: A Stunning Debut

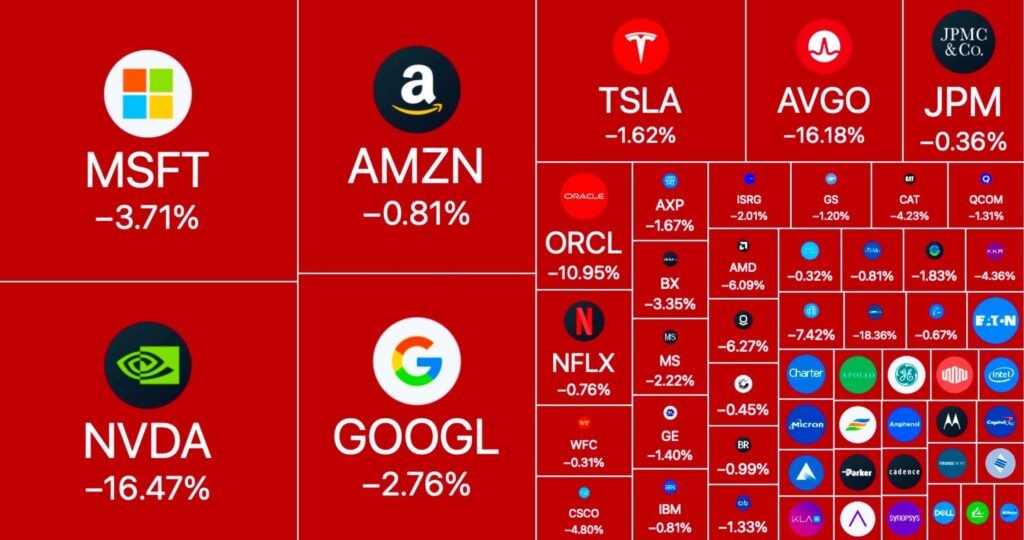

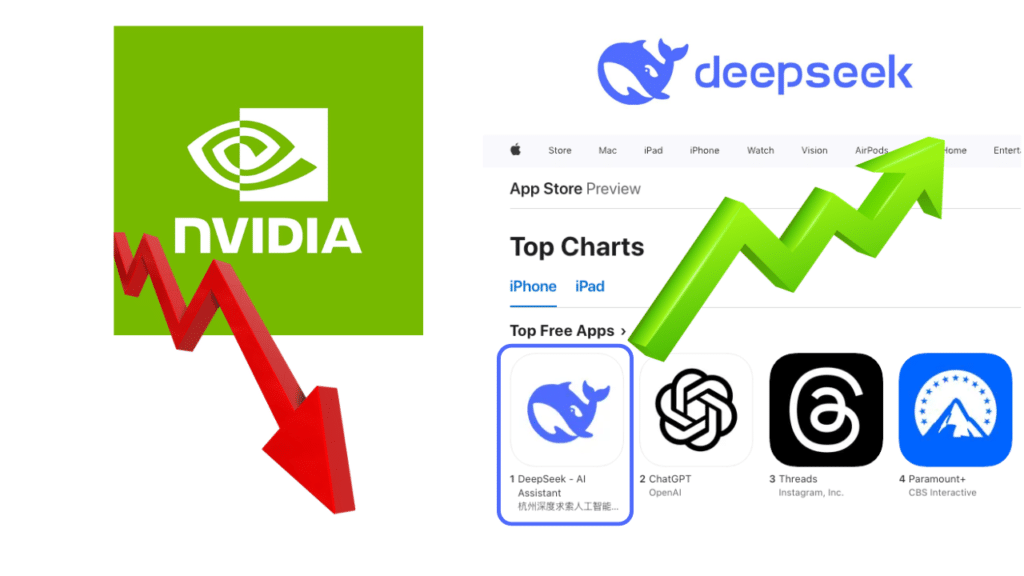

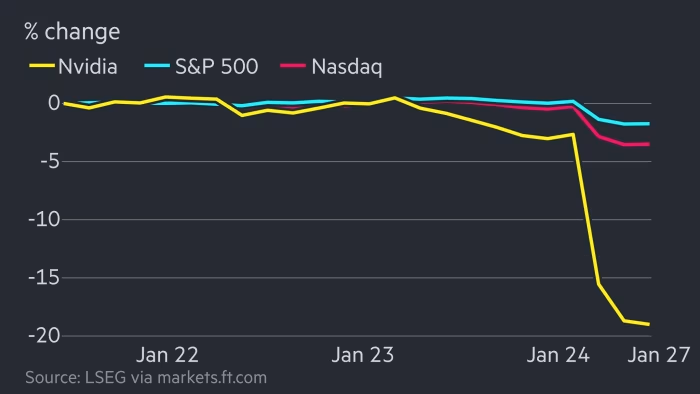

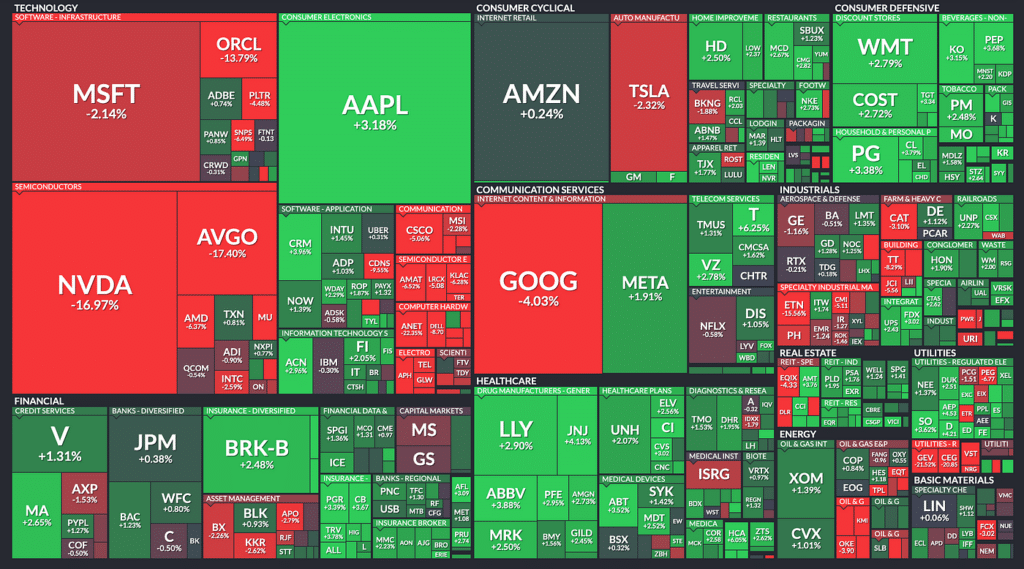

Developed by a startup led by Chinese hedge fund manager Liang Wenfung, DeepSeek quickly gained international attention over the weekend. It became the most downloaded free app on Apple’s US App Store. By Monday, its impact was felt far beyond the app marketplace. The chatbot triggered a massive sell-off in U.S. tech stocks. Notably, Nvidia—one of the most prominent names in AI hardware—lost $600 billion in market value in a single day. According to Bloomberg, this marked the largest single-day market value drop in U.S. stock market history.

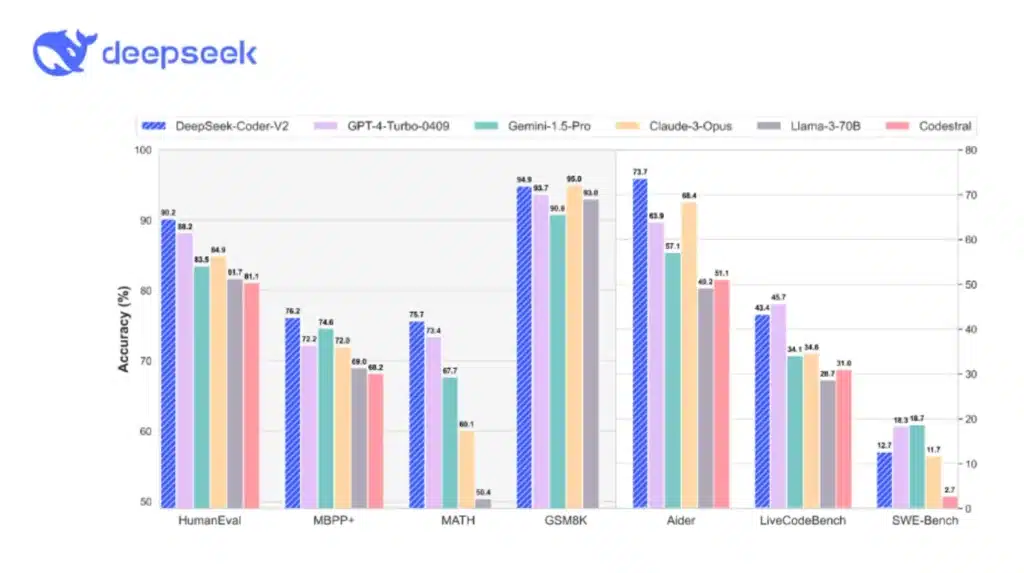

DeepSeek’s appeal lies not just in its functionality but in its astonishing affordability. Its developers claim that the model was built for a mere $5.6 million, a figure that stands in stark contrast to the billions spent annually by tech giants like OpenAI, Google, and Anthropic. For context, OpenAI reportedly burned through $5 billion in 2024 alone. The disparity has left industry leaders scrambling to understand how DeepSeek managed to achieve such results with a fraction of the resources.

DeepSeek’s disruption was felt around the world.

The Cost Controversy: Fact or Fiction?

DeepSeek’s low-cost claims have sparked intense debate across Silicon Valley. Analysts, investors, and tech leaders are grappling with the question: How is this possible? Some have speculated that DeepSeek’s operations may be subsidised by Chinese government initiatives or private investors with deep pockets. Others believe the company may have leveraged cost-saving measures, such as the use of open-source software and existing hardware, to slash expenses.

Veteran tech analyst Gene Munster voiced his skepticism, stating:

“Their model is surprisingly good, which just makes it hard to believe the financials.”

Munster also questioned whether DeepSeek’s numbers reflect its true development costs or if external factors, such as long-term chip stockpiling, played a role.

Despite the controversy, what’s clear is that DeepSeek’s emergence has forced Silicon Valley to confront the possibility. AI innovation may no longer require the astronomical budgets it once did. This revelation could fundamentally alter the dynamics of AI development. It could make it more accessible to smaller players.

A Geopolitical Power Play: China’s AI Flex

DeepSeek’s success has been widely interpreted as a strategic flex by China, showcasing the country’s technological prowess and challenging the U.S.’s dominance in the AI space. The parallels to the Sputnik satellite, which marked the Soviet Union’s early lead in the space race, are striking. Just as Sputnik spurred the U.S. to accelerate its space exploration efforts, DeepSeek has reignited the AI arms race, with China seemingly taking the lead.

China’s dominance in rare-earth metals, which are essential for manufacturing AI hardware, and its wealth of engineering talent have long been seen as key advantages. Reports suggest that Liang Wenfung’s hedge fund, High-Flyer, has been stockpiling GPUs (graphics processing units) for years in anticipation of this moment. By utilising Nvidia’s H800 chips, DeepSeek’s developers were able to create a high-performing model. This was achieved despite U.S. export restrictions on advanced semiconductor technology.

This development raises important geopolitical questions about the future of U.S.-China relations in the tech sector. Will the U.S. government reconsider its export policies to counter China’s growing influence? Or will it focus on fostering domestic innovation to maintain its edge?

The Fallout: Tech Stocks in Freefall

The repercussions of DeepSeek’s debut were not limited to Nvidia. Major U.S. tech stocks, including Alphabet (Google’s parent company) and Microsoft, also experienced sharp declines. The widespread sell-off reflected mounting concerns that the U.S. might be losing its competitive edge in AI innovation.

Traditionally, AI development has been seen as a capital-intensive endeavour requiring vast compute power and expensive infrastructure. DeepSeek’s use of cost-effective strategies challenges this notion, raising questions about the sustainability of current industry practices. As President Donald Trump acknowledged in a recent press conference, DeepSeek’s success represents a “wake-up call” for American tech firms to reevaluate their strategies.

DeepSeek’s Disruption liquidated billions around the world.

The AI Arms Race: A New Chapter

Just days before DeepSeek’s launch, OpenAI CEO Sam Altman and Oracle co-founder Larry Ellison stood alongside Trump to unveil Stargate, a $500 billion initiative aimed at cementing U.S. dominance in AI. The project, which promises massive investments in data centers and the creation of 100,000 new jobs, exemplifies the bullish attitude of American tech leaders toward their position in the AI race.

However, DeepSeek’s arrival has injected a sense of urgency—and humility—into this narrative. Altman, typically a vocal advocate for OpenAI’s capabilities, was notably subdued following the app’s launch. In a late-night post on X, he described DeepSeek as “impressive” and acknowledged that competition from the Chinese startup could be invigorating for the sector.

What Makes DeepSeek Unique?

DeepSeek’s app has earned praise for its performance, with users highlighting its ability to generate accurate and contextually relevant responses. However, questions remain about whether it truly rivals industry-leading models like ChatGPT. Critics argue that while DeepSeek may excel in specific tasks, its scalability and long-term viability are yet to be proven.

The app’s reliance on open-source software has been a key factor in its low-cost development. By leveraging publicly available frameworks, DeepSeek’s developers avoided the high costs associated with proprietary technologies. This approach could serve as a blueprint for other startups looking to enter the AI space without the backing of billion-dollar budgets.

A Wake-Up Call for Silicon Valley

For the U.S. tech industry, DeepSeek’s success is a stark reminder that dominance in the AI sector is far from guaranteed. While companies like OpenAI, Google, and Microsoft continue to lead in terms of resources and infrastructure, DeepSeek has demonstrated that innovation can come from unexpected places.

Marc Andreessen’s description of this moment as AI’s Sputnik moment underscores the high stakes of the current AI race. Just as the U.S. responded to Sputnik with a renewed focus on space exploration, it must now rise to the challenge posed by DeepSeek. Whether this leads to increased investment in domestic AI development or a reevaluation of current strategies remains to be seen.

DeepSeek’s Disruption caused major financial problems this week.

The Road Ahead: Implications for the Global AI Landscape

DeepSeek’s emergence has not only disrupted the technology industry but also reshaped the global AI narrative. Its low-cost, high-performance model challenges long-held assumptions. These assumptions concern what it takes to develop cutting-edge AI technologies.

For smaller players, DeepSeek’s success is an encouraging sign that the barriers to entry in the AI space may be lower than previously thought. For established giants, it serves as a warning that even the most well-funded companies are not immune to disruption.

As the AI race heats up, the focus will likely shift toward efficiency and adaptability. Companies that can deliver high-quality models at lower costs will have a significant advantage in the evolving landscape.

Conclusion: A Turning Point for AI

DeepSeek’s debut represents a turning point for the AI industry, challenging the dominance of established players and reshaping perceptions of what is possible in the field. Whether it marks the beginning of a new era of innovation or a fleeting moment of disruption, one thing is clear: the stakes have never been higher.

As the dust settles, the world will be watching to see how the U.S. tech industry responds to this unexpected challenge. Will it rise to the occasion, or will DeepSeek’s success signal a shift in the balance of power in the AI race?

Check out: UAE CRYPTO: THE FUTURE OF FINANCE