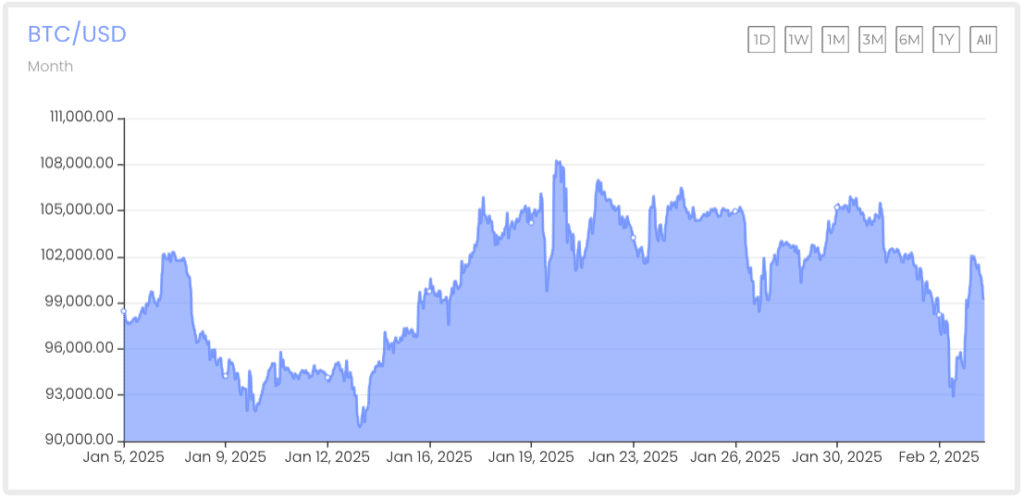

As the Bitcoin dominance soars in the crypto market and hit a four-year peak, with altcoins struggling under intense market pressure, more attention has been given to recent political announcements. With $2.29 billion in liquidations recorded in the past 24 hours and geopolitical factors shaking investor confidence, the market remains in a volatile state. Here’s what you need to know this week.

1. Bitcoin Dominance Climbs as Altcoins Crash

Bitcoin’s market share continues to rise, hitting levels not seen since 2019, as altcoins face significant losses. While BTC has dropped by 4-5%, Ethereum (ETH), XRP, Solana (SOL), and BNB Coin (BNB) have seen steeper declines of 10-15%, further solidifying Bitcoin’s dominance.

This shift reflects investors moving away from riskier assets, opting for Bitcoin as a safer store of value amid market uncertainty.

2. Crypto Market Sees $2.29 Billion in Liquidations

The crypto market has witnessed one of its biggest liquidation events in recent months, with total liquidations crossing $2.29 billion within 24 hours. Long traders have faced the biggest blow, with $1.91 billion in long liquidations recorded.

Coinglass data suggests that extreme volatility could continue, but some analysts believe this correction phase might soon reverse.

Bitcoin Dominance Soars.

3. Trump’s Trade War Adds Pressure on Crypto Markets

The latest market downturn comes amid growing fears over Donald Trump’s trade policies, which have already impacted traditional markets. Trump has fulfilled his pledge to impose 25% tariffs on Canada and Mexico, leading to concerns over economic instability.

Speaking to reporters, Trump stated:

“We may have short-term some little pain, and people understand that. But long-term, the United States has been ripped off by virtually every country in the world.”

These comments have added to global investor uncertainty, contributing to Bitcoin’s latest pullback.

4. Analysts Spot Familiar Patterns Hinting at an Altcoin Rally

Despite the bearish trend, seasoned analysts like Juice and Skew have identified similar patterns to previous altcoin rallies. Crypto trader Skew noted “capitulation wicks”, which indicate that many altcoins have been heavily oversold.

Juice, a well-known market analyst, highlighted on X (formerly Twitter):

“BTC.D is printing almost the exact same pattern as it did just before last alt season kicked off… Look what happens next… ALTSEASON.”

This has sparked renewed speculation that the ongoing correction could be the final dip before a major altcoin rebound.

5. Market Optimism Remains Despite Volatility

While the short-term outlook appears bearish, some traders remain hopeful that Bitcoin will stabilise without breaking its established range. Analyst Roman Trading noted that Bitcoin is currently sitting in a key support zone, suggesting a bounce could be imminent.

Meanwhile, former BitMEX CEO Arthur Hayes has reiterated his view that Bitcoin will eventually surge towards $75K, stating:

“The pain stops when a TradFi outfit is on the verge of bankruptcy. Then the Fed reluctantly joins team Trump and prints that money. And then you better be ready to buy crypto like you have never bought before.”

Bitcoin dominance soars this week.

Final Thoughts

Bitcoin’s dominance remains strong despite the broader market sell-off, with altcoins struggling to find support. While liquidations and geopolitical tensions have added to the pressure, analysts see this as a potential precursor to an upcoming altcoin season.

With Bitcoin hovering near a key support level, all eyes are now on whether this correction marks the end of the dip—or the beginning of something bigger.