CRYPTOCURRENCY

KASPA is the New Bitcoin

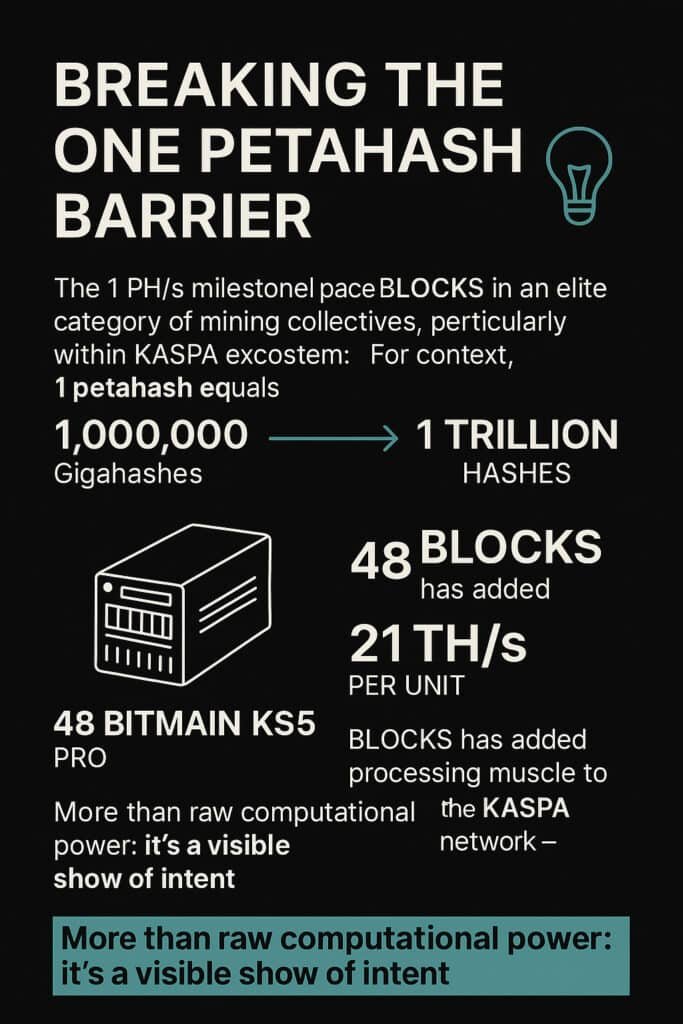

In a transformative move set to ripple through the mining and decentralised finance landscape, the BLOCKS team has shattered a major benchmark — officially exceeding one petahash (1 PH/s) of unchained mining power. The catalyst? The recent acquisition of 48 Bitmain KS5 Pro miners, marking a defining leap forward in BLOCKS’ mission to become a dominant global force within both the KASPA mining scene and the broader blockchain infrastructure layer. Many are now suggesting that KASPA is the new Bitcoin in this evolving landscape.

While much of the crypto space fixates on short-term speculation, BLOCKS is laying the groundwork for longevity. This achievement isn’t just technical — it’s strategic. Coupled with a highly anticipated token launch, an aggressive mining strategy, and a clear, transparent roadmap, BLOCKS is positioning itself not merely to participate in the future of decentralised technology, but to lead it.

💡 Breaking the One Petahash Barrier: Why It Matters

The 1 PH/s milestone places BLOCKS in an elite category of mining collectives, particularly within the KASPA ecosystem. For context, one petahash equates to 1,000,000 gigahashes per second, or a trillion hashes being processed every second in the effort to validate and secure the blockchain.

The newly deployed Bitmain KS5 Pro units — currently among the most powerful KASPA-specific ASIC miners available — offer a hashrate of 21 TH/s per unit, with power efficiency optimised for sustained scalability. By onboarding 48 of these machines, BLOCKS has added a substantial chunk of processing muscle to the KASPA network — reinforcing its credibility not just as a passive participant, but as an infrastructure heavyweight.

The rise to one petahash represents more than raw computational power — it’s a visible show of intent.

🚀 Token Airdrop Scheduled: May 24, 2025

Further fuelling the excitement is the scheduled launch of the BLOCKS token. Set to commence on 24 May 2025, the launch will begin with a 25% airdrop to initial holders — a bold strategy designed to jumpstart decentralised adoption and reward early supporters.

The drop is backed by more than just ambition — it follows a highly successful origin token sale which raised over 2 million KASPA, demonstrating strong community belief in the project’s vision. This capital, paired with the expanding in-house mining fleet, gives BLOCKS one of the most tangible token infrastructures among upstart protocols today.

What distinguishes the BLOCKS token rollout is its organic architecture — rather than a conventional VC-backed pre-sale or aggressive yield farming campaign, BLOCKS has chosen a slow-burn entry with performance-based growth, designed to align community value with network contribution.

🔐 A Transparent, Doxxed Team with Real Vision

Trust remains a cornerstone of decentralisation. Unlike anonymous developers or faceless syndicates, the BLOCKS team has taken a refreshingly public and transparent approach, with fully doxxed profiles and open channels of communication. This level of accountability is still rare in the mining sector and provides a notable contrast to the secretive operations that plague many mid-tier crypto ventures.

Their ethos is simple: decentralised finance should be earned, not gamed. By choosing transparency, BLOCKS attracts long-term believers — not just token flippers.

🔄 Why KASPA Is The New Bitcoin

While mining is central to the BLOCKS operation, their ambitions go far beyond hashrate and power efficiency. The team is actively building a modular ecosystem around the BLOCKS token, positioning it as an essential asset within KASPA-aligned DeFi.

Long-term roadmap features teased in early communications include:

- Staking pools

- Validator infrastructure

- Decentralised data storage

- Mining-as-a-Service (MaaS) options for retail users

- On-chain governance integration

The success of these verticals depends not on hype but on continued trust, computational capacity, and verifiable economic distribution — all of which the team is delivering in measurable strides.

⚡ KASPA Upgrades to 10 BPS: A New Speed Benchmark

While BLOCKS makes its moves, the broader KASPA ecosystem is also reaching critical mass.

On 5 May 2025, KASPA officially rolled out its highly anticipated upgrade to 10 Blocks Per Second (BPS) — a massive leap from its already efficient throughput. This upgrade cements KASPA’s position as the fastest Layer-1 cryptocurrency ever built, surpassing both Solana and Avalanche in native transaction finality.

For miners and network builders like BLOCKS, this increased speed means greater volume, tighter validation cycles, and more efficient block rewards — all within a decentralised, proof-of-work framework.

This upgrade isn’t merely cosmetic; it redefines what performance can look like in a blockchain context without compromising on decentralisation or energy efficiency.

🐳 Whale Wallets: Binance or OKX?

In parallel with technical upgrades and new players entering the space, analysts have observed massive accumulation in key wallets. One in particular — referred to as Wallet Two by the KASPA community — is closing in on 700 million KASPA.

Speculation has been mounting: is this Binance preparing for an eventual listing? Could it be OKX, whose recent DePIN pushes have aligned closely with proof-of-work chains? Or is this a new sovereign accumulation play from Asia or the Gulf?

While there’s no official confirmation yet, one thing is certain: this wallet is strategically active, disciplined in accumulation, and is not showing signs of distributing. That’s a clear vote of confidence in the future value of KASPA.

📉 Why BLOCKS Stays Away From VC-Backed Projects

As the crypto market continues to clean up its act, stories of massive token dumps by venture capital funds are still too common.

Take Mantra — a project that recently saw its value collapse by over 90%, after early investors offloaded vast quantities of tokens, draining retail confidence and destroying months of community growth.

This is exactly what the BLOCKS team is trying to avoid.

Their project deliberately avoids the conventional VC path — choosing instead to bootstrap from the inside out with:

- Public mining

- Community-first token allocations

- No hidden vesting cliffs

- No unfair early access schemes

By avoiding VC involvement, BLOCKS ensures that no single party holds disproportionate influence — a core tenet of true decentralisation.

🔎 KASPA: Why It’s Needed Now More Than Ever

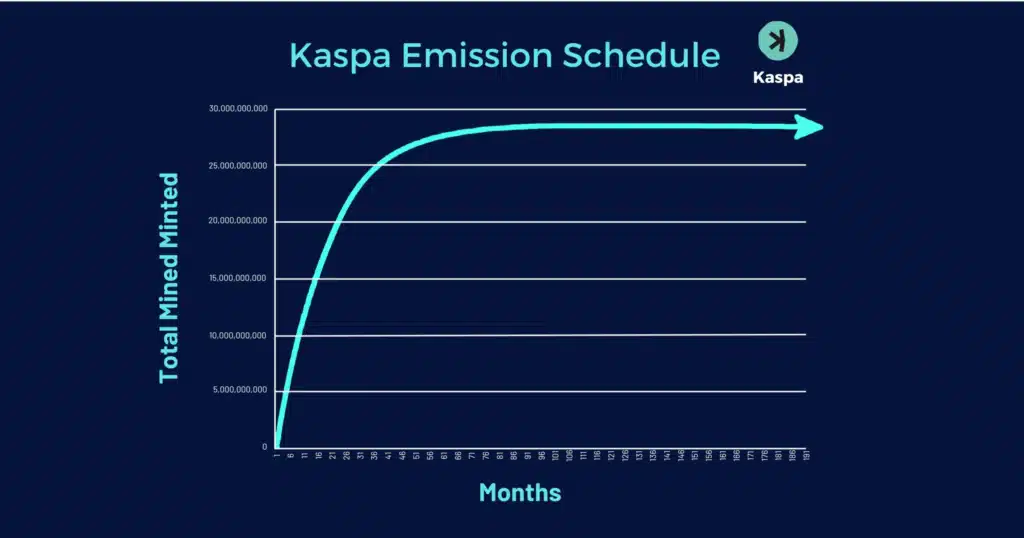

Beyond technology, beyond economics — KASPA represents an ideological stand.

In a world increasingly dominated by surveillance finance, CBDCs, and privately held “crypto” chains disguised as decentralised solutions, KASPA reaffirms the values that made cryptocurrency revolutionary in the first place:

- Decentralisation

- No pre-mines

- No VCs

- Fair distribution

BLOCKS, by choosing to build exclusively within the KASPA ecosystem, is aligning itself with a growing rebellion against the corruption of fiat money, gatekeeping of capital, and centralisation in disguise.

📊 By The Numbers: BLOCKS in May 2025

| Metric | Value |

|---|---|

| Mining Power | 1.008 Petahash |

| Bitmain KS5 Pro Units | 48 Machines |

| Token Launch Date | 24 May 2025 |

| Airdrop Allocation | 25% to holders |

| KASPA Raised (Origin Sale) | 2 Million KASPA |

| Network Speed (Post-Upgrade) | 10 Blocks Per Second (BPS) |

| Whale Wallet (Accumulation) | ~700M KASPA |

📣 Final Thoughts: This Is Just the Beginning

The story of BLOCKS and its strategic stake in the future of KASPA is just unfolding.

While other projects chase influencers and clickbait headlines, BLOCKS is building real value, brick by brick, block by block. Backed by a doxxed team, real mining capacity, and a launch strategy rooted in community, their trajectory is clear.

This isn’t just another token launch. It’s a declaration: that fair systems, built transparently, with decentralisation as the bedrock — still have a place in this space.

KASPA’s upgrade to 10 BPS and BLOCKS’ leap to 1 PH/s aren’t just numbers — they’re signals. Signals that a new standard is being set.

The question isn’t whether this movement will succeed. It’s whether you’ll be part of it before everyone else catches on.

CRYPTOCURRENCY

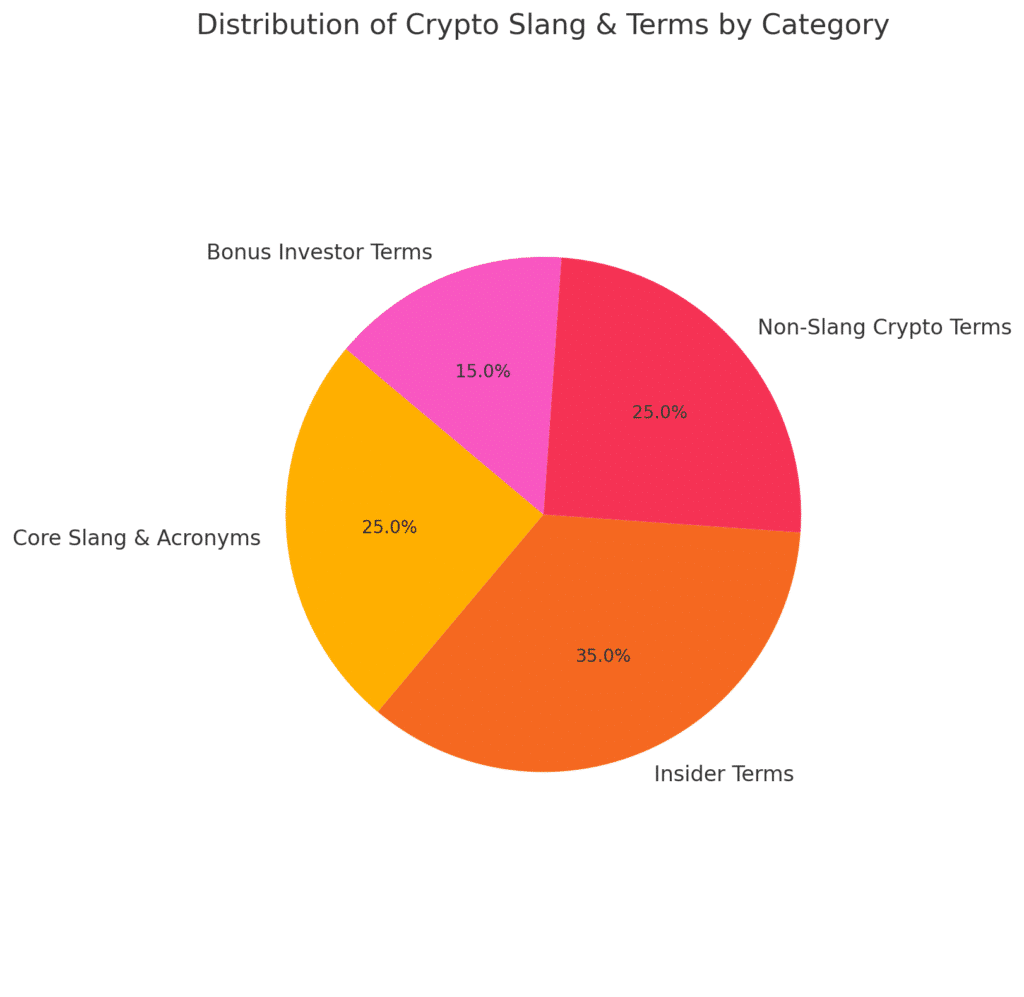

A Guide to Crypto Slang Terms: Talk Like a Pro in Web3

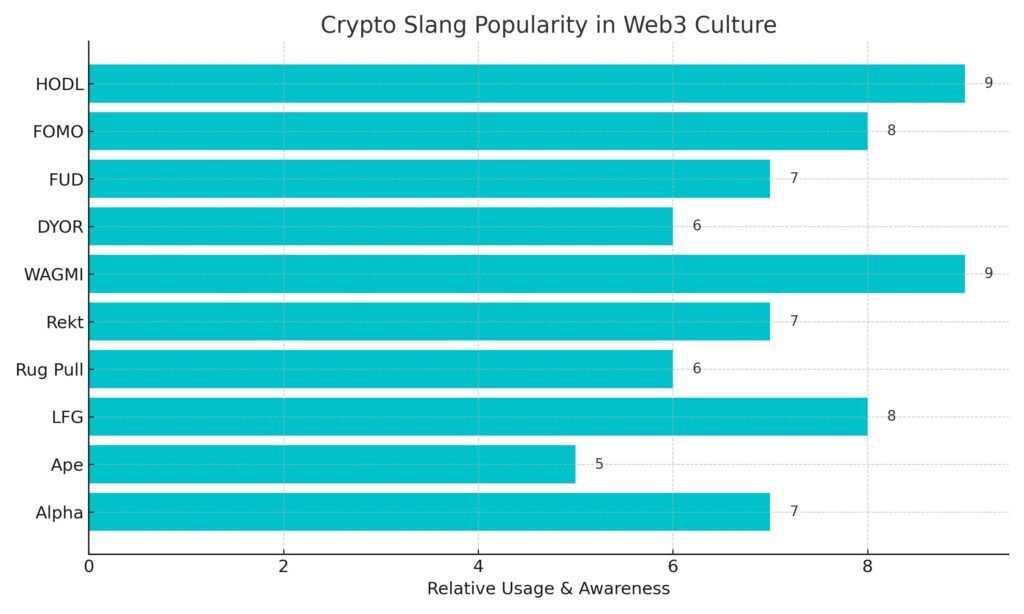

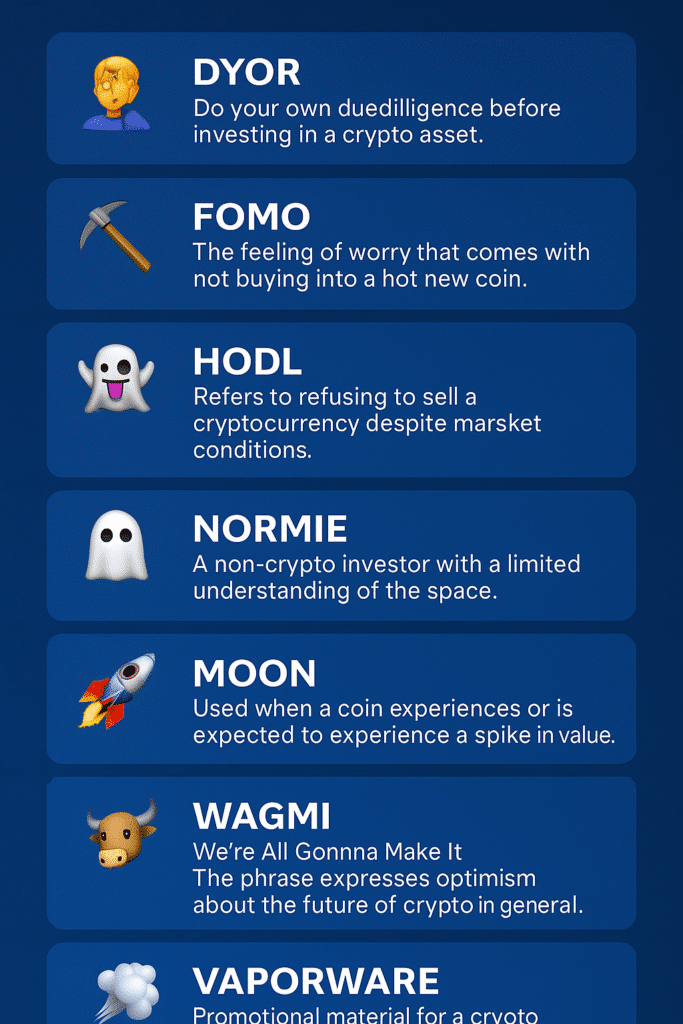

Venturing into the world of cryptocurrencies can feel like stepping into a linguistic labyrinth. With slang terms like HODL, vaporware, and DYOR being tossed around like crypto confetti, it’s easy to feel like a complete outsider.

What is alpha in crypto slang? Why are people calling me a normie? Why do I keep seeing people shout WAGMI or LFG like it’s a war cry?

This guide breaks it all down. It decodes the acronyms, memes, slang, and buzzwords that populate the fast-moving, meme-rich, often chaotic world of crypto.

Now, let’s get fluent.

🧠 Core Crypto Slang & Acronyms

AMA: Ask Me Anything

Think Reddit-style Q&A sessions hosted by projects, influencers, or founders. They’re a chance for direct engagement and community-building. Got questions? Fire away.

BTD / BTFD: Buy The (F***ing) Dip

This one’s a rallying cry. When prices crash, brave (or reckless) investors swoop in. BTFD has become both a meme and a mindset.

DYOR: Do Your Own Research

A mantra. A warning. A survival tool. During the ICO madness of 2016–2018, many newcomers got burned by scams. DYOR reminds investors that no one is responsible for your money except you.

FML: F*** My Life

Markets dipped 40% overnight? Gas fees wiped your profit? A perfect time to drop an FML.

FOMO: Fear Of Missing Out

Greed meets impatience. Don’t let FOMO push you into bad trades. Use logic over hype.

FUD: Fear, Uncertainty, Doubt

Whether malicious or misguided, FUD spreads negativity. Spot it, resist it, and stay focused.

GM: Good Morning

Crypto Twitter’s way of saying, “We’re still early.” A nod of optimism, solidarity, and Web3 vibes.

GMI / WGMI / WAGMI: Gonna Make It, We’re Gonna Make It, We’re All Gonna Make It

During market crashes, this crypto chant rallies spirits. It’s about community. Belief. Copium.

GOAT: Greatest Of All Time

Reserved for game-changing protocols, devs, or influencers. Think: Satoshi. Vitalik. CZ.

HODL: Hold On for Dear Life

Born from a drunken Bitcoin forum typo in 2013 (“I AM HODLING!”), it now means holding your assets regardless of volatility. A badge of honour for true believers.

IYKYK: If You Know, You Know

Used when referencing insider alpha or niche events. Often seen on NFT Twitter or DAO governance threads.

LFG: Let’s F***ing Go

Crypto pumps? Bullish news? Meme coin mooning? Spam LFG in all caps.

NGMI: Not Gonna Make It

The opposite of WAGMI. Used to call out bad investments, poor decisions, or failed projects.

PFP: Profile Picture

In NFT land, PFP = your avatar identity. Think Bored Apes or CryptoPunks.

SAFU: Secure Asset Fund for Users

Binance’s response to its 2018 hack. Now slang for exchanges that protect user funds.

WAGBO: We Are Gonna Be Okay

A calming signal when prices crash. Less aggressive than WAGMI, but just as optimistic.

🧩 Crypto Phrases & Insider Terms

Alpha

Hot tips. Market insights. Insider info. True alpha gives you a competitive edge. But beware: it’s often diluted by wannabe influencers shouting “Alpha!” at basic advice.

Ape / Apeing

FOMO-fuelled investing without research. Don’t ape in—DYOR.

Bagholder

You bought the top. You didn’t sell. Now you hold worthless tokens. Welcome to the club.

Bitcoin Maximalist

They believe Bitcoin is the only crypto worth owning. Everything else? Trash.

Cryptojacking

Secretly using someone else’s computer power to mine coins. A stealthy form of theft.

Cryptosis

The obsession with all things crypto. Reading charts, watching videos, checking prices… every 15 minutes.

Degen

Short for “degenerate.” Risk takers who ape into low-cap coins hoping to 100x. They thrive on volatility.

Diamond Hands

Unshaken. Steadfast. Willing to HODL through hell and back. Often used with 💎🙌.

Flippening / Flappening

Flippening = Ethereum surpassing Bitcoin in market cap (hasn’t happened). Flappening = Litecoin surpassing Bitcoin Cash (did happen).

Floor is Lava

In NFT markets, when the floor price (lowest price) surges fast—it’s said to be lava.

Going to the Moon / Mooning

When a coin’s price skyrockets. “Wen moon?” = “When will we get rich?”

No-Coiner

Someone who owns no crypto and often bashes it. The crypto world’s version of a sceptic.

Normie

Your uncle who says, “Bitcoin is just a fad.” Anyone outside the crypto bubble.

Not Your Keys, Not Your Coins

Don’t leave your crypto on exchanges. Use a private wallet. Otherwise, you don’t really own it.

Paper Hands

The opposite of diamond hands. Nervous investors who sell at the first red candle.

Pump and Dump

Market manipulation 101. Inflated hype → price pumps → early holders dump → chaos.

Rekt

Financial ruin. “Bro I got rekt buying that meme coin at the top.”

Rug Pull

When devs vanish with investors’ funds. A Web3 exit scam. Protect yourself by verifying teams and contracts.

Scamcoin

Useless crypto launched with hype, no utility. Only goal: enrich the founders.

Shill / Shilling

Pushing a coin or project (usually for personal gain). Trust no one. DYOR.

Sweeping the Floor

Buying up the cheapest NFTs in a collection, often to boost perceived value.

Vaporware

A project with no real product or roadmap. All hype. No delivery.

Whale

An individual or entity that holds enough crypto to move markets. Their buy/sell decisions ripple across the space.

When Lambo?

A meme meaning “When will I get rich enough to buy a Lamborghini?” It represents moon-mad dreams.

🧾 Essential Non-Slang Crypto Terms You Must Know

Altcoin

Any cryptocurrency that isn’t Bitcoin.

ATH: All-Time High

The highest price a token has ever reached.

ATL: All-Time Low

The lowest price ever. Often used to find “bottoms” or entry points.

Bearish

Expecting prices to fall.

Bullish

Expecting prices to rise.

CEX: Centralized Exchange

Platforms like Binance, Bybit, Kraken. Easy to use. Custodial wallets. More beginner-friendly.

DAO: Decentralised Autonomous Organisation

A community-run organisation with no central leadership. Governance via token voting.

dApp

Decentralised Application. Runs on blockchain. Examples: Uniswap, OpenSea.

DeFi

Decentralised Finance. Lending, borrowing, and trading without intermediaries. Power to the people.

DEX: Decentralised Exchange

Trade directly from your wallet. Peer-to-peer. No account needed. Example: Uniswap.

KYC: Know Your Customer

The verification process required by most CEXs. Usually involves submitting ID.

Mint

The process of creating a new token or NFT.

NFA: Not Financial Advice

A disclaimer used to avoid legal liability. Still—take it seriously.

P2E: Play-to-Earn

Games where you earn crypto rewards. Combines fun with income potential.

📊 Bonus Terms for the Observant Investor

Gas Fees

The cost of executing a transaction on a blockchain, especially Ethereum. Can spike during high activity.

Layer 1

A base blockchain like Ethereum or Solana.

Layer 2

Built on top of Layer 1 to improve scalability (e.g., Arbitrum, Optimism).

Tokenomics

The economic design of a cryptocurrency, including supply, distribution, and incentives.

Hash Rate

The total computational power used in mining a cryptocurrency.

Smart Contract

Code that runs on blockchains to automate actions (like a vending machine that pays out only when conditions are met).

Staking

Locking up your crypto to support a network and earn rewards.

Halving

Occurs in Bitcoin every 210,000 blocks (~4 years). Cuts miner rewards in half, reducing supply.

🧭 Final Words: Talk the Talk, Walk the Wallet

Crypto is more than tech and tokens—it’s culture. From WAGMI memes to HODL chants, this world communicates through layered language. Learning the slang helps you connect, stay safe, and avoid rookie mistakes.

So whether you’re deep in DeFi, minting NFTs, or just here for the vibes—now you speak the lingo.

And remember: always DYOR. Because in crypto, knowledge is alpha.

CRYPTOCURRENCY

Bitcoin Surges Past $110K as Market Trading Volume Spikes 50% Overnight

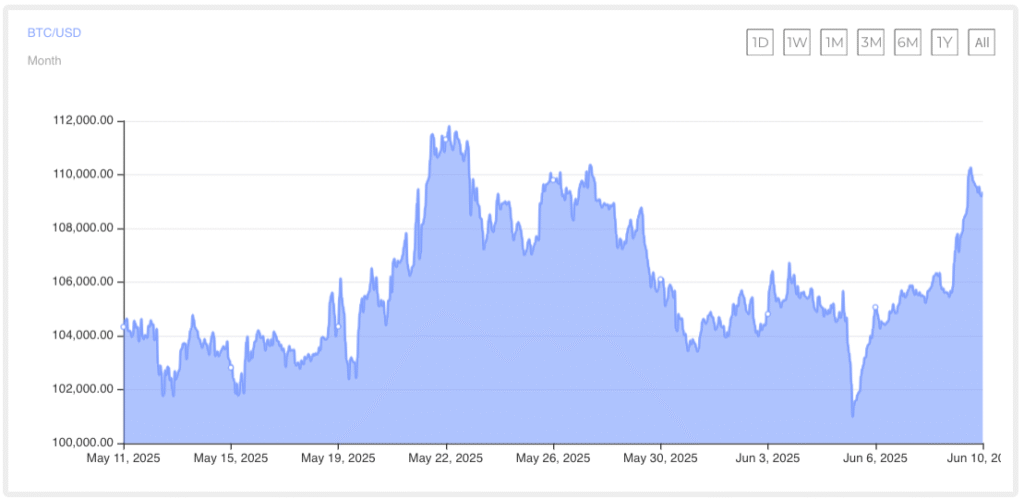

Bitcoin Surges Past $110K as it has officially crossed the $110,000 threshold, a milestone that confirms Bitcoin’s ability to surge past $110K and cement a major comeback in the cryptocurrency space. With daily charts showing a high of $110,500, Bitcoin has broken through the $105K resistance zone with conviction. This sharp move upward highlights how Bitcoin surges past $110K after weeks of consolidation and uncertainty, marking a turning point in what many are now calling a new bullish cycle. Over the past 24 hours alone, Bitcoin has increased by 3.7%. For the week, it’s gained 3.8%, with 5.4% growth in the past 30 days and 34% over the last 90 days. Year-to-date, it’s sitting at a healthy 16% increase. As Bitcoin surges past $110K, investors and analysts are keeping a close watch on how the cryptocurrency continues to evolve.

Historical Context: The Foundations of This Breakout

To understand the significance of this rally, one must consider the historical patterns Bitcoin has followed. In late 2017, Bitcoin reached its then all-time high of $20,000 before tumbling in early 2018. The 2021 cycle saw it explode past $60,000, spurred by institutional ETF involvement and mainstream financial integration through platforms like PayPal. However, macroeconomic tightening and inflationary pressures led to a price contraction in 2022 and 2023, dropping Bitcoin to ranges between $30K and $40K. The run-up to 2025 has been more structured. Following the April 2024 halving, Bitcoin slowly climbed back toward $109K in Q1, briefly derailed by market anxieties, including the February Bybit hack and rising geopolitical tensions.

This time, however, Bitcoin’s trajectory is not just driven by hype but by solid structural shifts, including significant institutional backing, on-chain strength, and macro tailwinds.

Bitcoin Surges Past $110 K as Market Trading Volume Spikes 50% Overnight

The Price & Volume Story: What Just Happened?

In a textbook example of market sentiment flipping from caution to optimism, Bitcoin surged from $105K to $110,500 in what analysts are calling a decisive breakout. Buying pressure accelerated near the $105K support zone, with algorithmic traders triggering further momentum as Bitcoin approached the psychological $110K mark. The most eye-catching statistic? A 50% increase in 24-hour trading volume, now sitting at an estimated $58.5 billion.

This isn’t just a retail-driven spike either. Volume spikes of this magnitude typically reflect increased institutional involvement, making this rally far more sustainable than previous cycles dominated by speculative buying.

On‑Chain & Exchange Supply Dynamics

Behind the scenes, on-chain data reveals even more bullish indicators. The amount of Bitcoin held on centralised exchanges has dipped below 2.5 million BTC—a level not seen since before the 2021 bull run. This drop signals a long-term trend: investors are pulling their coins off exchanges and into private wallets or cold storage, reducing the available liquidity for immediate sale.

This kind of exchange reserve decline has historically preceded price surges. Additionally, Glassnode reports that long-term holders have begun taking modest profits, but with the vast majority continuing to accumulate. The data strongly supports the view that Bitcoin is transitioning from distribution to a fresh phase of accumulation.

Bitcoin Surges Past $110 K

Institutional & Corporate Accumulation Trends For Bitcoin

The real force behind Bitcoin’s 2025 momentum lies in institutional demand. Spot Bitcoin ETFs from names like BlackRock and Fidelity have collectively drawn in over $11 billion in inflows. But the big players aren’t stopping there.

MicroStrategy remains a poster child for corporate adoption. In May, the firm added 7,390 BTC to its holdings at an average price of $103,500. This brings their total to a staggering 576,230 BTC, valued at approximately $63 billion. Meanwhile, Japanese investment firm MetaPlanet is raising $50 million through zero-interest bonds to increase its BTC exposure.

Even unexpected players like GameStop and several unnamed mid-tier firms are ramping up their exposure, all contributing to a supply-side crunch and a mounting wave of conviction-led investment.

Regulatory Tailwinds: Self‑Custody in Focus

In a major shift, US regulators are beginning to acknowledge the importance of self-custody. On 9 June 2025, SEC Chair Paul S. Atkins addressed the DeFi Task Force, stressing that digital asset ownership should align with “foundational American values.”

Atkins criticised outdated regulatory frameworks that slow innovation, instead advocating for clarity that empowers individuals and institutions alike. This emerging narrative around self-custody is creating a legal environment that encourages institutional adoption.

This sentiment isn’t limited to the U.S. either. The EU is implementing its MiCA regulatory framework, and the UAE continues to lead in Web3-friendly licensing through VARA and FSRA. Collectively, these developments are reducing regulatory uncertainty and encouraging long-term capital into the space.

Macroeconomic Backdrop & Bitcoin’s Hedge Role

Beyond crypto, macroeconomic shifts are working in Bitcoin’s favour. The April 2024 halving reduced the block reward to 3.125 BTC, inherently tightening supply. At the same time, the US Federal Reserve is hinting at possible interest rate cuts in response to declining bond yields and persistent inflation.

This macro backdrop increases Bitcoin’s appeal as a hedge asset. As traditional markets face turbulence, capital continues to rotate into Bitcoin as a form of digital gold, especially with its volatility-adjusted correlation to gold climbing over the past two months.

Technical & On‑Chain Metrics Deep Dive

The technicals are equally convincing. Bitcoin recently formed a bull-flag pattern, with a sharp rise from $90K to $105K, a brief consolidation, and then a breakout past the upper resistance line. This is further validated by a golden cross, where the 50-day moving average crossed above the 200-day average.

Momentum indicators like RSI (currently around 57) and MACD suggest there’s still room to run before BTC hits overbought conditions. Futures markets show growing open interest and positive funding rates, implying a bias toward long positions without being dangerously leveraged.

On-chain metrics round out the story. Active wallet addresses are up 8% week-on-week, and Bitcoin’s realised cap has crossed $900 billion, pointing to sustained network value. Whale wallets are steadily growing their balances, with stock-to-flow and NVT ratios supporting the bullish thesis.

Bitcoin Surges Past $110K

Regional Perspective: UAE & Middle East

The UAE is rapidly becoming a global crypto hub, and Bitcoin’s rise only amplifies this trend. VARA in Dubai and the FSRA in Abu Dhabi are already issuing licences to exchanges, custodians, and tokenisation firms. Local platforms like Rain, BitOasis, and Binance MENA offer easy access for both retail and institutional traders.

Family offices and HNWIs in the region are increasingly treating Bitcoin as a core part of their alternative asset portfolios. Some are even exploring Shariah-compliant BTC products or tokenised sukuk-like investment vehicles.

For What’s Hot in UAE, this shift presents huge storytelling opportunities. Think deep dives on UAE’s evolving regulatory environment, interviews with VARA officials, or investor education around cold storage and self-custody. This is the moment to build editorial authority in the region’s fast-moving crypto scene.

Bitcoin Surges Past $110 K as Market Trading Volume Spikes 50% Overnight

Forecasts: $150K by 2025—$250K on the Horizon?

Industry voices are becoming increasingly bullish. James Butterfill, Head of Research at CoinShares, forecasts Bitcoin could reach $150,000 before the end of 2025. Charles Edwards of Capriole Fund adds that Bitcoin’s volatility-to-gold ratio supports another leg upward, particularly if BTC holds above $110K on the daily close.

Standard Chartered also maintains its $150K prediction, while ARK Invest reiterates its long-term $1 million target by 2030. These projections are grounded in increased ETF inflows, strong institutional demand, and improving macro and regulatory conditions.

Here’s a breakdown of forecasted scenarios:

| Scenario | Price Range | Drivers |

|---|---|---|

| Base Case | $120K–$150K | ETF inflows, macro stability, self-custody clarity |

| Bull Case | $150K–$200K | Surge in ETF allocations, global liquidity expansion |

| Upside Case | $200K–$250K | Rapid adoption, central bank digital currency integration |

| Bear Case | $80K–$100K | Macro shocks, regulatory hurdles, profit-taking |

Risks to Watch

Even with this bullish momentum, caution remains prudent. With over 97% of the current BTC supply in profit, some level of profit-taking is expected. External risks like unexpected inflation spikes, central bank missteps, or regulatory crackdowns could also impact sentiment.

Additionally, derivatives markets remain a double-edged sword. Rising open interest increases the risk of liquidations, particularly if funding rates become skewed. And with fewer BTC held on exchanges, there’s also thinner liquidity at the top, meaning sharper swings, both up and down.

CRYPTOCURRENCY

Crypto Meme Coin News This Week

The world of crypto meme coins continues to move at lightning speed, and this week has been no exception in crypto news. From record-breaking price pumps to new exchange listings, meme coin mania is very much alive. Here’s everything you need to know about what’s been trending, what’s been dumping, and which coins are drawing major attention in the meme coin ecosystem right now.

🐸 PEPE Makes a Splash with New All-Time High

This week, PEPE surged to a fresh all-time high, hitting a market cap north of $6.2 billion. The frog-themed coin—initially launched as a joke—has outperformed many top 50 altcoins, driven by FOMO and relentless social media hype. PEPE has seen over 60% gains in the past 7 days alone, according to CoinMarketCap, and is now the third-largest meme coin behind Dogecoin and Shiba Inu.

Large whale movements suggest major accumulation, and crypto analysts predict further upside if Bitcoin stabilises above the $65,000 range.

“PEPE is doing what Dogecoin did in 2021—except faster,” tweeted @CryptoKaleo.

💥 BRETT Launches on New Exchanges

BRETT, the Base-native meme coin that’s become a cultural sensation on Crypto Twitter, was listed on Bybit and KuCoin this week. Its 24-hour volume peaked above $150 million, and it’s now up more than 80% in the last 10 days.

BRETT’s growing popularity is fuelled by the narrative around Coinbase’s Base network and broader bullish sentiment toward Ethereum L2s. The meme coin is also gaining traction as a bridge between meme culture and the on-chain Base ecosystem.

🚀 WEN and TURBO Rebound Strongly

Both WEN and TURBO posted strong comebacks after weeks of stagnation:

- WEN jumped 38% week-on-week after Elon Musk liked a meme referencing the token.

- TURBO reclaimed key support at $0.000090 and is now trending among top gainers on DEXTools.

Investors are speculating these coins could follow similar parabolic paths to PEPE, especially with new DEX aggregators promoting them across Telegram communities.

🐉 Rising Stars: Draggy, Pei Pei, Andy, Landwolf, Hoppy, Bobo & MEW

This week has also seen a new wave of meme coins catching serious momentum, and they deserve their flowers:

- Draggy is quickly becoming a community favourite with its stunning branding and a loyal base of holders rallying behind a playful yet bullish narrative. With NFT integrations and a vibrant roadmap, Draggy could be next in line for a major breakout. Crypto News favours this coin.

- Pei Pei, the cheeky panda-themed token, has exploded on TikTok and Telegram. With its strong meme appeal and unique Asian crossover cultural vibes, Pei Pei is drawing a global following.

- Andy continues to impress with a consistently rising floor and a meme game that rivals the big players. Its developers are rolling out utility features faster than expected, and the community is loving it.

- Landwolf is dominating Twitter spaces with one of the most vocal and unified communities out there. This canine-themed coin is building out a surprisingly deep ecosystem, and whales are quietly stacking.

- Hoppy is making waves as the feel-good meme coin of the season. With its adorable aesthetic and strong influencer support, it’s winning hearts and wallets alike.

- Bobo has transformed from meme underdog to serious contender. Analysts are noting its strong price floor, and its meme virality is reaching all corners of Crypto X.

- MEW (short for “My Ethereum Wallet”) is not just another cute token—it’s fusing meme culture with smart wallet utilities, offering both fun and function in one explosive package.

These rising stars prove the meme coin space is more than just a handful of names. Innovation, creativity, and passionate communities are fuelling this next generation of meme tokens.

📉 FLOKI Faces Sell-Off Amid Ecosystem Questions

Not all meme coins had a bullish week. FLOKI saw a 12% correction as doubts surfaced over its NFT roadmap and staking yields. While the project has deep community roots and strong branding, short-term technicals show signs of a continued retracement unless buying pressure returns soon.

🧠 AI-Powered Meme Coins: A New Trend?

Emerging meme coins like GENIE, AIKI, and CHATPEPE are riding the artificial intelligence wave. Many of these tokens claim to combine humour, decentralised governance, and AI-driven utility—though sceptics warn of vaporware.

One crypto coin to watch is GENIE, which promises to integrate a meme-themed AI chatbot with a decentralised tipping engine. It launched this week with $25 million in trading volume in its first 48 hours.

🔥 Crypto news Community Picks of the Week

Here are the top trending meme coins across Reddit, Twitter, and Discord:

- DOGEVERSE: New multichain meme coin that’s gaining traction for its bridgeability.

- KABOSU: Up 300% month-to-date, driven by nostalgia and Binance rumours.

- MOG: Surging due to memes alone, with zero utility—and proudly so.

- Draggy: Gaining fast with impressive marketing and major NFT hype.

- Pei Pei: Social media darling of the week.

- Landwolf: Dominating meme Twitter, with real community firepower.

- MEW: Combining utility and meme value with explosive growth.

📊 Meme Coin Market Overview (as of this week)

| Meme Coin | Market Cap | 7-Day Performance | Current Price |

|---|---|---|---|

| Dogecoin (DOGE) | $22.1B | +5.3% | $0.154 |

| Shiba Inu (SHIB) | $14.3B | +3.8% | $0.0000252 |

| PEPE | $6.2B | +62.4% | $0.0000176 |

| BRETT | $1.1B | +84.9% | $0.091 |

| TURBO | $280M | +40.2% | $0.000098 |

| FLOKI | $420M | -12.1% | $0.000212 |

| GENIE | $93M | New | $0.0034 |

| Draggy | $47M | +33.1% | $0.0043 |

| Pei Pei | $38M | +41.7% | $0.000092 |

| Landwolf | $52M | +49.3% | $0.00038 |

| MEW | $61M | +28.6% | $0.0021 |

(Crypto News Data from CoinMarketCap and DEXTools)

⚠️ Final Thought: Volatility is the Game

As always, crypto meme coins are high-risk, high-reward assets. With rapid market moves, celebrity tweets, and exchange listings swinging prices dramatically, anyone trading these tokens should proceed with caution.

But one thing’s for sure: the meme coin space is far from dead. It might just be heating up again.

-

Concerts3 days ago

Concerts3 days agoF1 Abu Dhabi Concerts Line Up 2025: Your Ultimate Guide to This Year’s Yasalam After-Race Shows

-

Health & Fitness2 weeks ago

Health & Fitness2 weeks agoHow to Whiten Teeth in the UAE — The Real Guide You Actually Need

-

Nightlife3 weeks ago

Nightlife3 weeks agoHow Boiler Room Became the World’s TV Nightclub

-

Comedy2 weeks ago

Comedy2 weeks agoDave Chappelle Live in Abu Dhabi: A Night of Comedy History at Etihad Arena

-

Tech3 weeks ago

Tech3 weeks agoWhat is Kahoot and Why Is It Everywhere?

-

Lifestyle3 weeks ago

Lifestyle3 weeks agoOfficial Images Of The Air Jordan 3 ‘Pure Money’

-

Health & Fitness2 weeks ago

Health & Fitness2 weeks agoIs Beef Tallow Actually Any Good for You?

-

Lifestyle2 weeks ago

Lifestyle2 weeks agoThe Justin Bieber Skylrk Brand: What We Know So Far